When Belonging is Broken: How an Intervention Can Strengthen Your Organization’s Culture

In 2020 companies spent $8 billion on diversity, equity and inclusion (DEI) initiatives. Research shows that over the past year, however, 64% of those in the workforce have witnessed or experienced microaggression or bias.

Why does this keep happening? How can employers foster a culture where everyone feels valued?

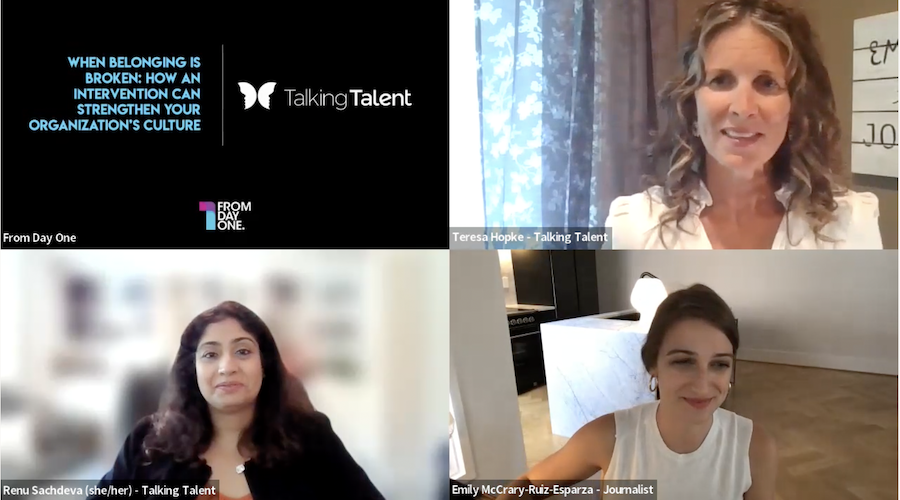

In a From Day One webinar, “When Belonging is Broke: How an Intervention Can Strengthen Your Organization's Culture,” experts from Talking Talent addressed those questions. Talking Talent helps large, global organizations build inclusive, fair and opportunity-filled work environments.

Through DEI initiatives, “We know that we can decrease stress, illness, depression, and isolation,” Teresa Hopke, CEO of Talking Talent, Americas, told moderator Emily McCrary-Ruiz-Esparza. Hopke said this is important because there’s currently an epidemic of loneliness in the United States, with 40% of people feeling isolated at work.

Part of the reason DEI initiatives are not showing results yet is because culture change can take five years or more, according to Hopke. However, she said employers are trying for “quick wins” through activities such as book clubs that can be a positive thing in the workplace but don't necessarily have a long-term impact.

“They aren't moving the dial in the way that we need them, because to do the real work, is really hard,” Hopke said.

Support for Chief Diversity Officers

Another problem is that many companies hired chief diversity officers or DEI directors but didn’t give them the resources they needed, according to Renu Sachdeva, Talking Talent’s head of client solutions for North America.

“When I say resources, I don't just mean money or staff,” she said. “I also mean actual support.”

According to Sachdeva, CDOs are frequently members of an underrepresented population, which sadly means they may feel isolated. “Just because the letter C in their title doesn't mean that they’re not experiencing their share of feeling dismissed, feeling unseen, feeling unheard being the only person who looks like them in the room full of people,” she said.

Another issue is companies sometimes assign someone to be a CDO simply because they are a person of color, even if they don’t have experience in changing systems, according to Hopke. “We’ve set them up to fail,” she said. “We have made the job really difficult for them. It’s no wonder they are feeling burnt out.”

For DEI initiatives to succeed, everyone in the C suite must not only “have the chief diversity officer’s back, but also be just as ardent advocates for the mission and vision of what the CDO is trying to do," Sachdeva said. This level of support from the executive team filters down through the organization's ranks.

DEI in a Post-pandemic World

Several recent studies show that those from marginalized groups who were able to work remotely during the pandemic were reluctant to return to the office because issues like microaggressions made it challenging for them to do their jobs in that setting.

“The reason that people are feeling anxious is because the same things they experienced before the pandemic are likely to exist after the pandemic because progress hasn't been made in a meaningful way,” Hopke said.

However, this issue could be a way for organizations to finally make the meaningful changes needed to create a culture of belonging, according to Hopke.

“A big piece of that is equipping and enabling leaders to be able to support people coming back in and making sure that leaders have the talking points and skill sets and capabilities to have conversations to ask people a simple question: ‘How do you feel about coming back?’” she said.

The next step is to address the concerns employees from underrepresented groups have about returning to the office. For example, they might be the only person of color on their team and feel pressure to educate everyone else on DEI. “I feel like they are exhausted by having to play that role,” Hopke said.

Another issue workers from marginalized groups struggle with is what they see as a need to “code-switch” in the workplace, which means changing their behavior, language, dress, and hairstyle to fit in. “We have to set up cultures that enable people to be authentic,” Hopke said.

Some employers are allowing workers to continue working from home at least part of the time. Employees making that choice include people of color and those with disabilities who saw a whole new world open to them during the pandemic. “The limitations that could exist in an office, they don’t have at home,” Sachdeva said.

However, those workers may find they are being left behind, according to Hopke. “We have to make sure the systems we have in place to measure and reward performance aren’t having gaps in promotion and pay because we’re only paying attention to the people who are in the office, and we’re not paying attention some of the people who may still be working from home some of the time, or maybe experiencing issues when they come back to the office that aren’t helping accelerate their career,” she said.

Finally, employers must encourage allyship, according to Hopke. “Everybody should be caring for each other and making sure we’re all OK right now,” she said.

Overcoming Resistance to DEI

Creating a culture of belonging requires everyone in the workplace to be committed to the goal. Unfortunately, some people are difficult to persuade.

“Usually, people ascend the ranks based on their technical skills, and that’s what they continue to build,” Sachdeva said. “But the human skills aren't necessarily always developed in the same intentional way in organizations.”

Empathy is “one of those key human skills, to just understand where people are,” Sachdeva said.

People often ask Sachdeva if empathy is an innate trait that someone is born with or not or if it can be taught. She said she believes individuals can learn how to be more empathetic, which helps them “be able to put ourselves in each other's shoes, and maybe get past some of those blocks that we may have,” such as belief systems they may have grown up with or zero-sum thinking – the idea that if one group makes gains, other groups lose something.

Overcoming those blocks takes time, and it can’t be done with a checklist, according to Hopke. “What you have to do is change people’s hearts and minds,” she said. “You don’t just tell them to change, or you don’t just tell them, ‘This behavior is annoying and you should stop doing that.”

Some companies are overcoming resistance to DEI by changing the title “chief diversity officer” to “chief belonging officer.” Sachdeva said many people yearn for a sense of belonging in the workplace, noting that the U.S. Surgeon General declared loneliness an epidemic earlier this year.

However, “I think what we have to be careful about is that we don’t lose the importance of DEI even if we call it by a different name,” Sachdeva said. “We still need diverse workforces. We still need equitable outcomes for the people in those workforces.”

Editor’s note: From Day One thanks our partner, Talking Talent, who supported this webinar.

Mary Pieper is a freelance reporter based in Mason City, Iowa.

The From Day One Newsletter is a monthly roundup of articles, features, and editorials on innovative ways for companies to forge stronger relationships with their employees, customers, and communities.