How Career Growth Can Be a Part of Employee Experience From the Start

For all the cultural discourse about employees today demanding greater respect and appreciation, a better work-life balance, and other intangibles like a sense of purpose, make no mistake: money still talks.

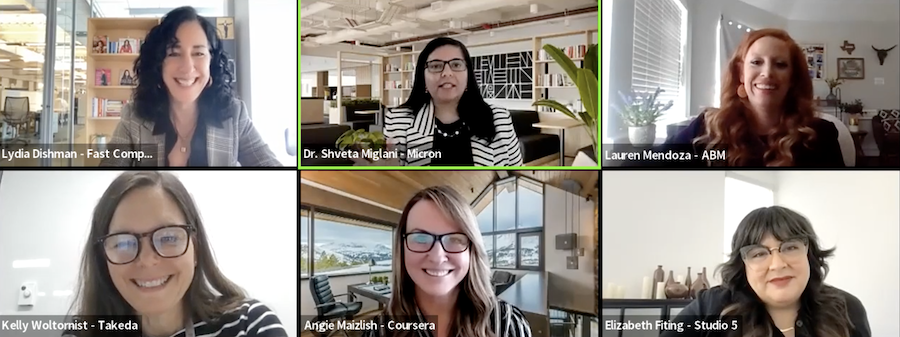

“We’ve all heard that people don’t leave jobs, they leave their bad bosses,” said Lydia Dishman, senior editor for growth and engagement at Fast Company, moderating a panel for From Day One’s April virtual conference. However, Dishman was also quick to point out Pew Research data that revealed that the number-one reason workers quit is low pay. And what was tied for the top spot? A lack of opportunities for advancement, which Dishman noted is also tied to earnings. The further they move up at a job, the more money they make.

Certainly, good company leaders who are dedicated to employee well-being should treat workers better and mindfully develop ways to do so–if only for the sake of productivity, higher retention rates, and a stronger bottom line. But they still need to fairly compensate team members and supply them with the promise of enhanced pay through career growth.

This commitment is a win-win for the employee and the employer, but how can organizations make it a reality for their team members? That’s what Dishman’s five panel guests discussed, and here are their key insights:

Establish a Learning Culture

“Creating an environment that values learning and encourages employees to experiment, share their knowledge and take on new challenges is really critical,” said Angie Maizlish, senior enterprise account executive at Coursera, the online learning platform that focuses on job skills.

That’s not only something Coursera advocates for, but lives by. Maizlish says the company recently launched a “Make-AI-athon,” which encouraged team members to engage with the burgeoning AI technology that’s made so many headlines of late and use it to build out email campaigns and other content.

“It’s really important again to, right from the start, develop that culture of learning [by creating] learning opportunities,” Maizlish continued. “Secondly, really developing a growth mindset in: ‘How do we learn from our mistakes?’”

Maizlish says that in sales, for example–the playground Maizlish operates in everyday—workers experience robust rejection. But persistence and resilience allow employees, based in sales or any other area, to grow from their “failures.”

Third, Maizlish says leaders must communicate expectations to establish a foundational understanding of what an employee can do to help a company and improve their chances of advancing within it. Employers should also establish mentorship programming, while providing feedback and recognition for learning accomplishments, too.

Take Learning to the “Micro” Level

Oftentimes, when a worker starts a new job and is onboarded, they feel overwhelmed by the glut of information projected at them. It’s unpleasant and, really, an enthusiastic employee—like the one you believe you just hired—just wants to be productive.

Elizabeth Fiting, chief learning officer at Studio 5, a creative agency that specializes in people development, says that workers are reaching out to learn things as part of their everyday jobs, but generally when it's immediately useful.

So, “rather than having content firehosed at them during onboarding,” Fiting explained, where about the highest expectation is that the worker will vaguely remember something being said about a given topic, “and maybe if they’re lucky they’ll remember where to find that information when they need it,” Fiting suggested people managers set up “microlearning” opportunities.

Microlearning isn’t just a small chunk of information that a worker can process and take with them. It’s “targeted” and “flexible,” Fiting said, and gives the employee the chance to utilize the information right away, as it is needed.

“They solve their problem, and then they move on, which makes a ton of sense when you think about the way that most of us are solving our problems in our everyday lives,” Fiting said. “If you have a leak in your kitchen sink, you’re not going online and Googling, ‘How do I get a plumbing certification?’ You are finding a video that a plumber has created showing you how to fix that leak, you’re fixing your leak, and then you’re moving on with your life.”

What does microlearning look like in onboarding—which is programming that Studio 5 not only has in-house but helps other companies develop? Fiting says that, at Studio 5, there’s a practice of communicating what resources are available to employees. When employees get to a given “point of need,” they’re provided a short instructional video or easy access to a job aid that helps them complete a task.

This approach, Fiting said, “honors an individual’s experience” and the knowledge they already bring to the job, “while also providing them the support that they need when they need it.”

Make Learning a Daily Practice

Kelly Woltornist, head of global learning at Takeda, a Japanese multinational pharmaceutical company, says that her company’s people managers use onboarding as an opportunity to teach employees about the company’s history—which actually goes back 240 years—as well as its values, to create a sense of belonging and purpose. But the learning doesn’t end there for workers. In fact, it happens everyday.

“We do work in growth mindset,” Woltornist said. “We enable them to be curious, and we teach them how to learn.”

Much of this approach is founded upon layers of mindfulness and intentionality. Woltornist said employees are asked to consider, “How do you think about what you’re doing that day?” and “What can you extract from it?” They also identify a skill they can practice in their day-to-day duties, “but do it from a very deliberate perspective,” Woltornist said.

Takeda has also recently launched a learning experience platform that boasts high adoption rates and helps establish the company-wide culture of daily learning through a variety of content and interactive features.

“When people join the workforce, they’ve put their academic career behind them; they don’t like to think of themselves as students anymore,” observed Dishman. “I know that I railed against that the first couple of years after I graduated and entered the workforce.” She says she had a sense of “I got my paper,” proving that she’d already learned everything she needed to know. Since then, Dishman’s realized the value of new knowledge and continuing on through life with “a student mindset.” For her, “Everyday is a school day.”

Identify Key Skills

Employers can make growth a little easier for workers to wrap their head around if they first identify key skills the company will need its employees to develop over time. Not only does this future-proof the operation, it keeps workers engaged through learning.

Shveta Miglani, head of global learning and development at Micron Technology, a medical memory and storage solutions company, says this is a vital approach given the quick pace at which external markets evolve. To decipher the areas in which workers may need to upskill, Miglani advises people leaders and other executives to first conclude what their business goals for the next three to five years may be.

“Don’t think about moving fast,” Miglani told leaders listening in. “Think about scaling and starting with your function first.”

Encourage Employees to Identify Their Goals and Communicate Them to Managers

Narrowing down what employees should learn and how they can grow in ways that best serve their company and their own careers can be achieved through a “down-up” approach, too. Lauren Mendoza, director of organizational development at ABM Industries, a facilities management provider, says that, in addition to company executives figuring out business goals and targeting skills they want workers to develop, the process can also be inverted. Employees should identify their career goals, communicate them to managers and then collaborate on a potential pathway.

“If you are an employee, you are trying to think: ‘Where do I want to go?’ ‘How do I want to get there?’” Mendoza said. But employees should first consider, Mendoza noted: “What are you trying to achieve?”

Furthermore, employees should identify whether or not they are happy in their current role, or even if they need more time, experience, and education to determine their level of contentment. From there, they can think about vertical or lateral movements, Mendoza said.

“Maybe you are in the HR department, trying to become that subject-matter expert of any field within HR, and you want exposure to recruitment benefits, L&D, talent management–so many different areas,” Mendoza said. “Reach out, find a network, create an area where you can find mentors, and know your HR business partner.”

An employee’s direct people manager, Mendoza continued, is the person who can talk through available options for career paths and learning opportunities.

“‘Are there certain courses that are allocated at different levels?’ ‘Certain courses that are offered to high performers?’ ‘What is the high performer here?’” Mendoza said. “I think that those are all really good questions to ask your HR business partner.”

Michael Stahl is a New York City-based freelance journalist, writer, and editor. You can read more of his work at MichaelStahlWrites.com, follow him on Twitter @MichaelRStahl, and order his first book, the autobiography of Major League Baseball pitcher Bartolo Colón, at Abrams Books.

The From Day One Newsletter is a monthly roundup of articles, features, and editorials on innovative ways for companies to forge stronger relationships with their employees, customers, and communities.