Is Your Company Attractive to a Diverse Workforce?

Three out of four job seekers and employees consider a diverse workforce as an essential factor when evaluating companies and job offers, according to a 2020 Glassdoor survey.

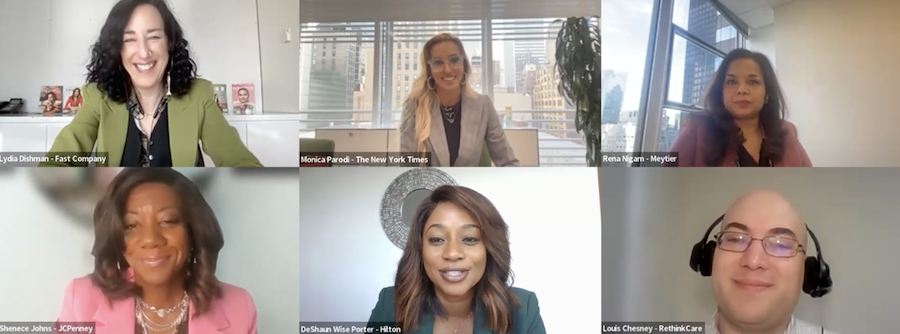

“Underrepresented candidates really care about the makeup of your organization and the actual numbers,” said Rena Nigam, founder and CEO of the AI-enabled hiring and talent intelligence platform Meytier, during a recent panel discussion at From Day One’s November virtual conference.

Ideally, employers will be able to show candidates that there are people who look like them across all company levels. But what if they aren’t there yet?

“If you’re still at the beginning of your journey, then be authentic,” Nigam told journalist Lydia Dishman, panel moderator. “Convey your intention on why you want to improve or why you have a lack of diversity.”

Overcoming Biases When Hiring

To create a diverse workforce, everyone involved in the hiring process needs education on how to recognize their own biases. Education can help “control some of those thoughts, and ensure that it doesn't allow you to make a decision based solely on those particular biases, but challenge it in the moment,” said DeShaun Wise Porter, global head of diversity and recognition at Hilton.

Shenece Johns is the head of inclusion and diversity at JCPenney, which is exploring how to use AI to attract talent. She says this technology is so new that the company is still navigating how to infuse it into the recruiting and hiring process.

“There could be bias when using AI, and we want to be mindful when we do decide to go full-steam ahead so that we don't inadvertently put our own unconscious bias into the system and discriminate,” she said. “We want to be intentional and methodical about how we approach it. We don’t want to screen out individuals based on their name, school, neighborhood, or other factors like that.”

But companies can employ AI to expand opportunities rather than automate rejection, says Nigam.

“We use an AI based ontology there to ensure that we discover things that people may not have stated,” she said. “We look beyond the obvious on people’s journeys.”

Skills vs. Traditional Metrics

Higher education is becoming more expensive, meaning many individuals can’t afford college. However, that doesn’t mean they lack skills, says Louis Chesney, neurodiversity program manager at RethinkCare.

“Even if you were to walk into an interview with a master’s degree, they care less about how many years you were in that environment, and more about if you can do the job,” he said.

Hilton has eliminated the four-year degree requirement for most of its positions in favor of looking strictly at the skill sets of potential employees, says Wise Porter.

“It afforded us an opportunity to truly evaluate and determine what is honestly needed for a particular role,” she said.

Monica Parodi, vice president of talent acquisition for The New York Times, said that as a federal contractor, the organization uses a structured, consistent, and inclusive interview process where the questions are all tied back to skills.

“The training needs to be there for recruiters to make sure that anything that veers away from skills and might show bias in debriefs returns right back to the skills qualifications for the role,” she said.

Leaning into Corporate Values

Many companies have diversity and inclusion as one of their corporate values. However, those are just words on paper unless an organization truly embraces them.

The golden rule, ‘treat others as you want to be treated’ is one of the core values at JCPenney. Johns says it’s a phrase everyone is familiar with, so it’s a good way to connect everyone in the organization as well as job candidates. “We lead with that and we lean into it,” she said.

However, people can perceive values differently, which can cause bias, says Porter. She said it’s important to ask “appropriate behavioral-based interview questions to be able to get down to the crux of the matter for a consistent experience.”

The best way for an organization to communicate its values is to demonstrate them, says Chesney. That’s why it’s essential to provide a detailed interview agenda to job prospects. “This could level the playing field by giving all candidates the same information and expectations. It’s also important to be transparent about the accommodations process, which can help candidates with different needs to perform their best in the interview,” he said.

Connecting with Overlooked Candidate Pools

Nigam defined overlooked candidate pools as “people who see constant rejection. They are people who always end up in the job black hole.” These individuals include immigrants, caregivers, veterans, and those with disabilities, she says.

The New York Times is working on hiring practices across the board for anyone from historically marginalized groups, including people who are neurodivergent, says Parodi.

For example, the organization is moving away from panel interviews. Those interviews were created to reduce biases but have also excluded some groups, says Parodi.

Certain individuals might not perform as well during a panel interview because they may struggle with working memory or executive functioning, says Chesney. He said those struggles are amplified “when you’re getting rapid fire questions from multiple people.”

One of the most overlooked talent pools are those with criminal backgrounds, says Johns. “We are doing some work in this space to help with giving them a second chance,” she said.

Mary Pieper is a freelance reporter based in Mason City, Iowa.

The From Day One Newsletter is a monthly roundup of articles, features, and editorials on innovative ways for companies to forge stronger relationships with their employees, customers, and communities.